Four Smart Ways to Turn a Windfall Into Wealth

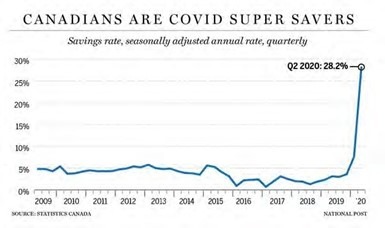

The pandemic has brought unexpected opportunities for frugal Canadians. We’ve been spending less and saving money in dramatically higher amounts. Statistics Canada observed a striking jump, from a paltry 2% or 3% of savings, to an impressive 28%, in the second quarter of 2020.

If this good news applies to you, congratulations! Now, it’s time to get busy. Below are four ways to work that windfall harder.

1. Crunch those credit cards first

Your first priority is paying down costly debt, such as high-interest credit cards. It’s smart to curb those interest rates which are stealing your cash flow. Before you consider anything else. While you’re at it, also get yourself onto a disciplined spending plan to ensure they don’t come back.

2. Strike a balance to build wealth

Ok, you’ve paid off those expensive cards. You may have other lower- interest debts. But your next move could focus on building wealth.

Consider a combination of both debt reduction and strategic wealth strategies. If your investments are providing you with good returns, then keep them in your mix of priorities.

3. Be a super saver

Of course, you want cash that’s liquid for emergencies or other plans. So, here’s a way to super-charge your savings. Leverage the power of a Tax- Free Savings Account (TFSA) to flexibly build your wealth.

The real power of this account comes from holding investments in it—not just cash—and, unlike an RRSP, you can withdraw from it at any time.

Bonds, stocks, mutual funds, exchange-traded funds and many other investments can be included in this tax-sheltered account. You won’t have any capital gains, interest income, or dividend taxes. Through the power of compounding, you can see very satisfying improvements in your bottom line by continually reinvesting your returns.

4. See what you can tolerate

If you are sitting on an excess lump sum, consider upping your risk tolerance. You can afford to experiment with some new investments. Look for ones offering potential returns higher than your usual comfort level.

Turn that windfall into more wealth. Ask your Financial Advisor for advice about well-managed mutual funds and a TFSA-friendly plan.